Top 10 Car Insurance Companies UK

ar Insurance in 2024 is more expensive than ever, and that means it is more helpful than ever to know what the best car insurance companies in the UK are. We have that sorted for you. We have done an analysis of every major UK insurance company, and below you will find a detailed summary of their strengths and weaknesses. So that in these times of soaring car insurance costs, you can still find the best insurer and best deal for you. Whatever type of car insurance you are looking for, we have assembled a list of the top 10 car insurance companies in the UK for you.

The type of car insurance you choose will depend on your individual needs and circumstances. Different types of car insurance are available, such as liability, comprehensive, and third-party insurance. The best car insurance company for you will be the one that provides the best coverage at the most competitive rate. Some of the top car insurance companies in the UK include Aviva, Direct Line, Admiral, and LV=. When looking for car insurance, it is important to compare different companies and policies to find the best coverage at the most competitive rate. Consider factors such as cost, coverage, customer service, and discounts. Additionally, make sure that the company is reliable and has a good reputation.

Choosing the best car insurance company can be a difficult task. Research different companies, compare their policies and coverage, and look for the best deal. Consider the overall cost of the policy, the type of coverage you need, and the customer service offered by the company. Check the company’s financial stability and its BBB rating to make sure the company is reputable and trustworthy. Consider shopping around for the best deals, raising your deductibles, reducing coverage for older vehicles, and taking advantage of discounts to reduce the cost of your policy. Different types of insurance, such as liability, uninsured motorist, collision and comprehensive, personal injury protection, and gap insurance, also need to be considered. It is important to compare policies and providers to find the best coverage and price for your needs.

The best car insurance companies in the UK vary depending on the type of insurance required. For example, if you are looking for the best value for money, Admiral, Direct Line, and Aviva are all highly rated. For those looking for comprehensive cover, Aviva, and Allianz are all recommended. For those looking for temporary car insurance, Tempcover is a great option. For black box cover, Churchill is the best choice. For convicted drivers, Swinton is highly recommended. Finally, for over-50s, Saga is the best choice. It is important to compare policies from different companies to ensure you are getting the best cover for your needs.

Blog Contents

1. Saga

Saga is a British insurance company founded in 1951. Saga’s headquarters are based in Kent, England. Saga Insurance provides a range of insurance products, including travel, home, car, pet, and life insurance. Saga Insurance is part of the Saga Group, which is a FTSE 250 listed company. Saga is primarily known for car insurance policies geared towards older drivers and is a specialist insurer for the Over 50s group. The coverage options through Saga are Saga Standard Coverage, Saga Select Coverage, and Saga Plus coverage. Each subsequent insurance bracket has more advantages than the last. These policies are specifically designed for people over the age of 50, with accordant competitive pricing for this age bracket.

Saga has an overall average insurance rate, with different average insurance rates across different brackets. The average insurance rate varies for good drivers, drivers of a medium standard, and for new drivers. The average cost of comprehensive car insurance in the UK for Q1 of 2022 was £416.

Saga is one of the top-rated auto insurance companies within the United Kingdom. Saga has a defaqto rating of five stars from the period 2013-2022. They became a Which? recommended car insurance provider in February 2022, and Saga won in all five motor insurance categories at the 2022 Consumer Intelligence Awards, including customer trust and claims satisfaction. These ratings are based on consumer intelligence, claims satisfaction, and overall customer satisfaction, with an average rating of 9 out of 10 for overall customer satisfaction.

As Saga is regulated by the Financial Conduct Authority, they are required to publish a summary of complaints that they have received. In the period February 2022 – July 2022, Saga received 9616 complaints, which amounts to 5.7 complaints per 1000 policies in force or a complaints rate of 0.57%, with the most common complaints relating to general admin and customer service.

Pros of Saga car insurance company

- No admin fees: Without administration fees, customers will save money on upfront costs, as well as on ongoing costs associated with their account.

- Protected No Claim Discount: No Claim Discounts (NCDs) can help you save money on your insurance premiums. The more years you go without making a claim, the greater the discount.

- Uninsured driver promises: Unaffected No Claims Discount if you are involved in a collision with an uninsured driver.

Cons of Saga car insurance company:

- Different Insurance Tiers: Different tiers such as Saga Plus offer different levels of benefits are services, with pricing to match

- Limited customer base: Specialist insurance for people over 50 may not apply to many customers

- Pricing: Saga Insurance Company may not have the most competitive rates and discounts due to the number of benefits and services on offer

Saga can be considered the best car insurance provider due to competitive rates, a wide range of coverage options, and special benefits such as discounts on car hire and breakdown cover. Additionally, Saga offers a variety of customer service options, including a live chat feature, making it easy to get in touch with a representative for help with questions or claims. Saga’s coverage options include comprehensive cover, third party fire & theft and third party only. Comprehensive insurance offers the widest range of coverage for your car, including accidental damage, theft, fire, and other damages to your vehicle. It also covers damage caused to other people and property, as well as legal and medical costs.

This information about Saga can be seen in the table below:

| Company | Average Annual Rate | Complaint Level | Handling Claims | Customer Loyalty Advantages |

|---|---|---|---|---|

| Saga Insurance | £416 Comprehensive | 0.57% | Good | Uninsured Driver Promise |

2. CSIS

CSIS (Civil Service Insurance Society) is a UK-based motor insurance company from Maidstone, England, founded as early as 1889. CSIS Insurance is a leading provider of insurance products for businesses and individuals. The company offers a range of products including property and casualty insurance, life insurance, health and disability insurance, financial products, and employee benefits. CSIS is a Not-for-Profit organisation and a registered charity in the UK. Being a Not-for-Profit organisation, all available profits are donated back into Civil and Public Service charitable organisations.

CSIS is primarily known for their car insurance policies and is a specialist insurer for Civil and Public Servants. Common coverage options through CSIS are comprehensive and third-party fire and theft coverage. CSIS aims to provide specialist insurance policies for Civil and Public Servants by offering a range of quality products at competitive prices.

CSIS has an overall average insurance rate, with different average insurance rates across different brackets. The average insurance rate for good drivers, drivers of a medium standard and new drivers vary. The average cost of comprehensive car insurance for the first quarter of 2022 in the UK was £416.

CSIS is one of the top-rated auto insurance companies within the United Kingdom. CSIS has a rating of 4.7 on Trustpilot. Trustpilot’s reviews are based on customer experiences with a specific business, product, or service. Reviews are typically provided by customers who have used the product or service, and may include ratings, comments, photographs, or other media. CSIS was voted as the most trusted car, home, and travel insurance provider in the Moneywise Magazine Annual Awards.

Pros of CSIS car insurance company:

- No administration fees: Without admin fees, customers will save money on upfront costs, as well as on ongoing costs associated with their account.

- Voluntary excess: By agreeing to pay a larger amount towards any claim you make, you are reducing the risk to the insurer and in turn can reduce your premium.

- Optional motor legal and breakdown cover: Included protection in the event of an accident.

Cons of CSIS car insurance company:

- Premium costs: Premiums may be higher than with some other insurers.

- Specialist provider: The insurance that CSIS provides is more suited to Civil Servants and related professions and may not be for everybody.

- Cover types: CSIS offer more limited coverage options than other providers due to their specialist nature.

CSIS can be considered the best car insurance provider due to their customer service options, multi-policy and loyalty discounts, and charitable donations. CSIS’s coverage options include medical assistance or Repatriation, with the main advantages of this being the range of options available to the insured party.

This information about CSIS can be seen in the table below:

| Company | Average Annual Rate | Customer Services | Handling Claims | Customer Loyalty Advantages |

|---|---|---|---|---|

| Civil Service Insurance Society (CSIS) | £416 Comprehensive | Legal Expenses Included | Good | Free 24-hour motor legal advice |

3. Direct Line

Direct Line is a UK based motor insurance company based in Bromley, England. Direct Line was founded in 1985. Direct Line became part of Direct Line Insurance Group after its formation in 2012 and is an FTSE 250 company.

Direct Line is primarily known for car insurance and is a specialist insurer for direct car insurance. Direct Line was the first direct car insurance company. Common coverage options through Direct Line are car insurance and home insurance, however they do offer a wide range of general insurance products. Direct Line has an overall average insurance rate of £554 for a comprehensive policy as of August 2022, with different average insurance rates across different brackets. The average insurance rate for good drivers, drivers of a medium standard and new drivers vary in cost.

Direct Line is one of the top-rated auto insurance companies within the United Kingdom. Direct Line has a rating of 4.0 on Trustpilot. Trustpilot’s reviews are based on user experiences with a company, product, or service. Reviews are written by customers who have voluntarily shared their opinion and describe their experience with the company.

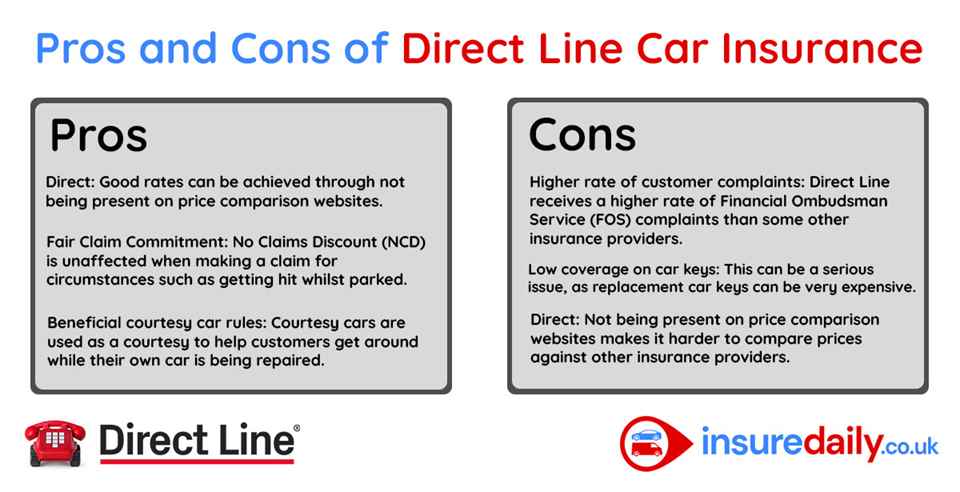

Pros of Direct Line car insurance company:

- Direct: Good rates can be achieved through not being present on price comparison websites, not having to pay commission and cutting out the middleman.

- Fair Claim Commitment: No Claims Discount (NCD) is unaffected when making a claim for circumstances such as getting hit whilst parked or damaged by a pothole.

- Beneficial courtesy car rules: Courtesy cars are used as a courtesy to help customers get around while their own car is being repaired, and are usually driven for short distances and for shorter amounts of time.

Cons of Direct Line car insurance company:

- Higher rate of customer complaints: Direct Line receives a higher rate of Financial Ombudsman Service (FOS) complaints than some other insurance providers. FOS is an independent body that provides free, impartial, and independent dispute resolution services to consumers who are not satisfied with the service they have received from financial services providers, such as banks and insurance companies. A higher rate of FOS customer complaints is bad because it indicates that customers are not satisfied with the services they are receiving and that the company is not meeting the needs of its customers. This can lead to a decrease in customer loyalty and can damage the reputation of the company.

- Low coverage on car keys: This can be a serious issue, as replacement car keys can be very expensive, and not having enough insurance coverage can leave an individual on the hook for the full cost of replacement.

- Direct: Not being present on price comparison websites makes it harder to compare prices against other insurance providers easily.

Direct Line can be considered the best car insurance provider due to their comparatively lower insurance rates, direct service, and customer advantages. Direct Line’s coverage options include third-party, fire and theft, comprehensive and comprehensive plus, with the main advantages of this being affordability and convenience. This information about Direct Line can be seen in the table below:

| Company | Average Annual Rate | Complaint Level | Customer Services | Customer Loyalty Advantages |

|---|---|---|---|---|

| Direct Line | £554 Comprehensive | High | Multi-car insurance discounts | Telematics for Younger Drivers |

4. Admiral Group

Admiral Group plc is a UK based financial services company headquartered in Cardiff, Wales. Admiral Group was founded in 1991 as a division of Brockbank Group. Admiral Group is an FTSE100 Financial Services Company. A financial services company is a business that provides financial services to individuals, businesses, and governments, such as banking, insurance, investments, loans, and asset management. Financial services companies may be made up of a single company, or a group of affiliated companies.

Admiral Insurance operates under Admiral Group, and provides Motor, Home, Travel and Pet Insurance policies, among others. Admiral Insurance launched as a specialist car insurance provider in 1993. Common coverage options through Admiral Group are Comprehensive, Third Party, Fire and Theft, and Third Party Only.

Admiral has an overall average insurance rate in line with the UK average. The UK average annual premium cost for car insurance in December 2022 was £773.74, with different average insurance rates across different brackets. The average insurance rate for good drivers, drivers of a medium standard and new drivers vary, and insurance rates can also vary by region. For the same month of December 2022, the average rate in England was £790.82, whereas the average insurance rate in Scotland was £669.77. The average rate in Greater London is the highest mainland rate, with £1006.98.

Admiral is one of the top-rated auto insurance companies within the United Kingdom. On Which? Admiral has a customer satisfaction rating of 68%. This rating is based on the application process, ease of policy management, and fair treatment of long standing customers. Admiral Group receives an average number of complaints, with the most common complaint being regarding the customer service procedure. This is reflected in the company rating.

Pros of Admiral Group car insurance company

- Stolen and Lost Key Cover: Covers the cost of replacement locks and keys in the case of loss or theft.

- Motor Legal Protection: Cover for legal expenses that may be taken because of an accident.

- Dash cam discount: Discounts to insurance premiums for having a dash cam installed and operational in a vehicle.

Cons of Admiral Group car insurance company

- No cover for misfuelling: If you accidentally fill your vehicle with the wrong type of fuel (Petrol / Diesel) you will have to front the repairs yourself.

- Expensive Windscreen Replacement Excess: Non-optional £115 windscreen replacement excess.

- Poor Claims Process Reviews: Multiple negative reviews on sites such as Trustpilot complaining about the claims reporting process and customer service issues.

Admiral is a good car insurance provider because they offer competitive rates and comprehensive coverage. They also have a Claims Promise. Additionally, Admiral offers a range of discounts for multiple cars, no-claims bonus protection, breakdown cover, and more.

This information about Admiral Group can be seen in the table below.

| Company Name | Average Annual Rate | Complaint Level | Handling Claims | Customer Services |

|---|---|---|---|---|

| Admiral | £773 | High | Poor | No Claims Discounts (NCD) match |

5. NFU Mutual

NFU Mutual is a UK based motor insurance brand based in Stratford-upon-Avon, England, and founded in 1910. Because NFU Mutual is a UK insurance composite, its executives and directors are directly accountable to policyholders and customers for how the company conducts business. Because NFUM is mutual, it does not have shareholders to hold it accountable. The full name of the organisation is National Farmers’ Union Mutual Insurance Society Limited.

NFU Mutual is primarily known for home insurance, landlord insurance, and car insurance. Common coverage options through NFU Mutual are comprehensive and third-party, fire and theft. NFU mutual do offer car insurance policies to the general public, but their policies do not cover all postcodes, particularly those in major cities, and risk profiles.

NFU Mutual is one of the top-rated auto insurance companies within the United Kingdom. In 2022, Which? recommended NFU mutual as their insurance provider of the year. NFU Mutual’s car insurance scored an outstanding 90% for customer satisfaction, through Which? who provided an overall score of 81%, ranking NFU Mutual first out of the total 49 insurance companies reviewed.

Based on complaints data from the financial ombudsman service, an analysis conducted by the Financial Times in 2017 found that NFU Mutual is the most accommodating insurer. Between April 2017 and September 2017, NFU Mutual received only 17% of all complaints, making it the insurer with the fewest complaints accepted.

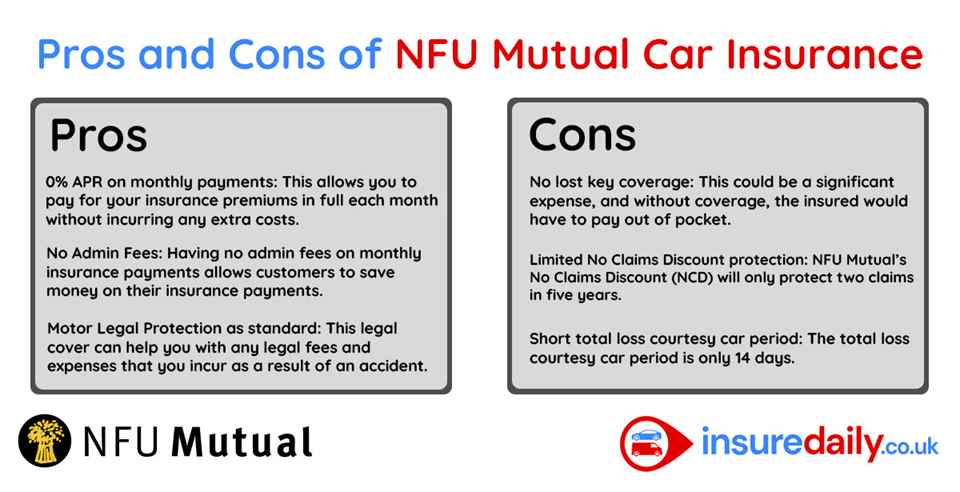

Pros of NFU Mutual car insurance company

- 0% APR on monthly payments: A 0% APR on monthly insurance payments is good because it means there are no interest charges or additional fees associated with the payment. This allows you to pay for your insurance premiums in full each month without incurring any extra costs.

- No Admin Fees: Having no admin fees on monthly insurance payments is a great thing for customers, as it allows them to save money on their insurance payments.

- Motor Legal Protection as standard: This legal cover can help you with any legal fees and expenses that you incur as a result of an accident, as well as providing access to a 24-hour legal helpline for advice and assistance. Having this protection as standard can ensure that you are properly covered in the event of a motoring dispute and can give you peace of mind that you will not be left with a large bill should something go wrong.

Cons of NFU Mutual car insurance company

- No lost key coverage: No lost key coverage is bad for car insurance because it means that if the insured loses their keys, they are responsible for the cost of replacing them. This could be a significant expense, and without coverage, the insured would have to pay out of pocket. Additionally, without coverage, the insured would be unable to drive their car until the keys are replaced, which could cause significant disruption and inconvenience.

- Limited No Claims Discount protection: NFU Mutual’s No Claims Discount (NCD) will only protect two claims in five years.

- Short total loss courtesy car period: The total loss courtesy car period is only 14 days. A short total loss courtesy car period is bad because it limits the amount of time you must use the courtesy car. This means that if you have an extended repair period, you may have to find alternate transportation. The short period also limits the convenience of a courtesy car and can cause additional stress and inconvenience.

NFU Mutual can be considered the best car insurance provider due to excellent customer service and satisfaction ratings, comprehensive coverage options, and competitive premium rates.

This information about NFU Mutual can be seen in the table below.

| Company Name | Complaint Level | Handling Claims | Customer Services | Customer Loyalty Advantages |

|---|---|---|---|---|

| NFU Mutual Insurance | Low | Good | RAC Mutual Assist Breakdown Cover | ‘Mutual Bonus’ to reward customers on renewal |

6. By Miles

By Miles is a UK based motor insurance company founded in 2016. By Miles is primarily known for their car insurance policies and acts as a specialist insurer for telematics-based insurance. Common coverage options through By Miles are fixed annual cost based for parked cars, with monthly payments varying depending on how regularly the car has been driven. The price for the insurance premium is calculated by the mile through a personalised per-mile rate.

Pay-by-the-mile insurance is a form of telematics, or “black box”, car insurance. You will be sent a telematics device to install in your car which will monitor your mileage. The device may also be linked to an app on your mobile phone, allowing you to track your miles and how much you are paying for each trip. These policies typically consist of two components – an annual fee to cover your vehicle when not in use, and a charge per mile rate that is based on your risk factors and the number of miles you drive annually.

This type of car insurance was designed specifically for those who drive least often, such as for infrequent, short trips (e.g., shopping, school runs), students who may only use their vehicles for occasional trips home or during holidays, young people who only use their cars for leisure and find annual insurance too expensive, and retired people who no longer need their vehicles for commuting to work. Conversely, this type of car insurance may not be suitable for those who make frequent use of their vehicles, such as for daily commuting between towns or cities to work, continental driving holidays, or business travel.

It is difficult to calculate an average rate for By Miles, since the price varies based on individual usage, with different average insurance rates across different brackets. When assessing the cost of your premium, several risk factors are considered, such as age and driving experience, where you live and park your vehicle, make and model of your car, your occupation, and your car insurance claims history.

For a middle-aged man living in an East Midlands town with a 20-year no-claims bonus and a seven-year-old 1.4 litre estate car, By Miles’ quote calculator offered a yearly standing fee of £172 and a driving charge of 3.2p per mile, regardless of the estimated mileage. This would translate to the following costs:

- 100 miles – £175.20

- 1,000 miles – £204

- 6,000 miles – £364

By Miles is one of the top-rated auto insurance companies within the United Kingdom. By Miles has a Trustpilot rating of 4.3. This rating is based on over 7000 independent reviews.

Pros of By Miles car insurance company:

- Personal usage scenario benefits: Pay-per-mile car insurance is a great option for people who do not drive very much, such as retirees, students, or people who work from home.

Cons of By Miles car insurance company

- Management: Pay-per-mile car insurance can be difficult to manage if you are not consistent with your driving habits.

- Estimates: It may be difficult to get an accurate estimate of your mileage since it can be difficult to track.

- Availability: By Miles is not an option for all drivers, such as drivers under the age of 25.

By Miles can be considered the best car insurance provider because they offer flexible pay-as-you-go car insurance based on how much you drive. This means that drivers can save up to £500 a year on their car insurance premiums by only paying for the miles they drive. By Miles also offers a range of coverage options, such as Comprehensive, Third-Party Fire and Theft and Third Party Only policies. They also offer a range of additional benefits, such as European cover and a courtesy car in the event of a non-fault claim. The main advantages of By Miles are that it offers drivers a flexible and cost-effective way to insure their cars, and that it provides comprehensive coverage options.

This information about By Miles can be seen in the table below:

| Company Name | Average Annual Rate | Complaint Level | Handling Claims | Customer Services | Customer Loyalty Advantages |

|---|---|---|---|---|---|

| By Miles | Yearly Standing Rate from £170, per-mile rates starting from 3p | Low | Good | Telematics with app monitoring | Reduced premiums for safe drivers |

7. Veygo

Veygo is a UK based motor insurance company based in Cardiff, Wales. Veygo is owned by Admiral Group and was launched in 2016. Veygo is primarily known for their car insurance policies and is a specialist insurer for short-term car insurance policies. Common coverage options through Veygo are flexible insurance, temporary insurance, and learner driver insurance. Short-term and temporary insurance policies can range anywhere from one hour to one month.

Estimated prices for temporary insurance through Veygo range from £2 p/h to £7.30 p/h, depending on the number of hours booked, or around £22 for a full day’s coverage. This price decreases to around £15 a day for 2 days insurance, and around £9 a day for a 7-day policy.

Veygo is one of the top-rated auto insurance companies within the United Kingdom. Veygo has a Trustpilot rating of 4.7. A Trustpilot rating of 4.7 out of 5 stars indicates that the product or service has been rated very positively by its customers. It means that most customers have had a positive experience and would recommend the product or service. Trustpilot’s ratings are based on customer reviews. Customers can provide ratings and reviews based on their experience with a company, product, or service. These reviews are then used to calculate the company’s overall rating on Trustpilot.

As a Financial Conduct Authority (FCA) registered company, Veygo publishes data publicly on their complaints record. From the period 01/01/2022-30/06/2022 Veygo had 69 complaints opened in total, with 62 of those closed. Of those closed, 50% were closed within 3 days and 45% were closed after 3 days but within 8 weeks. Of those complaints, 58% were upheld. The main cause of the complaints opened was general administration/customer service errors.

Pros of Veygo car insurance company

- Needs-tailored policies: Veygo offers short-term insurance policies that can be tailored to your needs, so you can get the coverage you need for the period you are driving.

- Upfront discount: Veygo offers a 10% discount to drivers who pay for their policy upfront.

- Customer service: Veygo offers 24/7 customer service, so you can get help whenever you need it.

Cons of Veygo car insurance company

- Limited Availability: Veygo is only available in the UK, so international customers will have to look elsewhere for their car insurance needs.

- No Breakdown Cover: Veygo does not offer breakdown cover, so you will have to purchase it from another provider.

- Cost: Short-term insurance policies are more expensive than annual policies, however this is reflected in the fact that they are taken out for less time.

Veygo can be considered the best car insurance provider as they understand that lifestyles are changing and allow people personalised control of their own journeys. They have temporary car insurance and learner driver insurance and are looking into more ways to help in the coming years. They have sold more than 1 million policies and are part of the Admiral Group. Their comprehensive insurance is underwritten by Admiral, voted Best UK Car Insurance Provider six years in a row by The Personal Finance Awards.

This information about Veygo can be seen in the table below.

| Company Name | Complaint Level | Handling Claims | Customer Services |

|---|---|---|---|

| Veygo | Low | Good | 24/7 support |

8. LV=

Liverpool Victoria, trading since May 2007 as LV=, is a motor insurance company founded in Liverpool, England. London Victoria was originally founded in 1843. LV= are currently based in Bournemouth, England. LV= offer a wide range of insurance and retirement products. LV= Car Insurance is primarily known for providing specialist insurance coverage for motorists. They are a specialist insurer for drivers who have previously been unable to get insured, such as young drivers and those with criminal convictions. Common coverage options include comprehensive cover, third party, fire & theft, and third party only. They also provide additional extras such as breakdown cover, personal accident cover, and legal protection. LV= offer more specialist insurance policies in the forms of Electric Car Insurance, Learner Driver Insurance, and multi-car policies.

LV=’s insurance policies cost as low as £219, which 10% of their total customers paid for their insurance premiums between May and October 2022.

LV= is one of the top-rated auto insurance companies within the United Kingdom. LV= has an 80% above average rating on Trustpilot.co.uk. LV= scores 9.1/10 on independent review site reevoo, 4.62/5 on smartmoneypeople.com, and reviews.co.uk has 62% of reviews recommending LV=. LV’s car insurance policies are rated five-stars by Defaqto.

Between January and June 2022, LV= opened 1306 complaints, which is 1.31 complaints opened per 1000 policies in force. In this period LV= closed 1305 total complaints. Of these closed complaints, 62% were closed within 3 days, 36% closed within 8 weeks, and 72% were upheld. The main cause of complaints opened was relating to General admin and customer service. This is reflected in the company rating.

LV= is committed to offering access to affordable and regulated financial advice to everyone for the emotional and financial advantages it provides. The company works with a wide range of financial advisors to help customers purchase the necessary products and services. The management team, which is experienced and driven, works to ensure that the firm is ‘Best Loved’ in the eyes of its brokers and that a relationship of the highest value is established.

Pros of LV= car insurance company:

- No Claims Discount: Guaranteed for uninsured drivers in accidents not your fault. No Excess to pay provided vehicle and driver details are known.

- Online Insurance Discount: At Least 5% Off, Excluding Add-Ons, when taking out an insurance policy through the online service

- Lifetime repairs guarantee: Lifetime Guarantee on repairs when using the recommended repairer service, Labour Only (Excluding Parts)

Cons of LV= car insurance company:

- Optional Extras: Motor legal expenses, guaranteed hire car cover, increased personal accident cover and breakdown cover can also be added to policies for an additional cost. These are not provided as standard.

LV= can be considered the best car insurance provider due to their consistent good customer feedback and reasonable pricing on their insurance premiums. As a company that has been running for over 175 years, LV= also has a longstanding historical reputation for delivering quality service as an established and well-respected brand.

This information about LV= can be seen in the table below.

| Company Name | Average Annual Rate | Complaint Level | Customer Services | Customer Loyalty Advantages |

|---|---|---|---|---|

| Liverpool Victoria (LV=) | £220+ | 1.31 complaints per 1000 policies | Online Insurance Discounts | Lifetime Repairs Guarantee |

9. TempCover

Tempcover is a UK-based motor insurance company based in London, England. Tempcover is now owned by RVU (since 2022) and was originally launched in 2009.

Tempcover is primarily known for their short-term insurance policies and is a specialist insurer for these types of policies. Common coverage options through Tempcover are flexible insurance, temporary insurance, and learner driver insurance. Short-term and temporary insurance policies can range anywhere from one hour to one month.

Estimated prices for temporary insurance through Tempcover range from £3.50 p/h to £9.50 p/h, depending on the number of hours booked, or around £27 for a full day’s coverage. This price decreases to around £19 a day for 2 days insurance, and around £12 a day for a 7-day policy.

Tempcover is one of the top-rated auto insurance companies within the United Kingdom. Tempcover has a Trustpilot rating of 4.8. A Trustpilot rating of 4.8 out of 5 stars indicates that the product or service has been rated very positively by its customers. It means that most customers have had a positive experience and would recommend the product or service. Trustpilot’s ratings are based on customer reviews. Customers can leave an honest review about their experience with Tempcover, which helps other customers make an informed decision.

Pros of Tempcover car insurance company:

- Flexible coverage: Tempcover offers customers the flexibility to tailor their coverage to meet their needs. Customers can choose from a variety of coverage levels, as well as additional options such as breakdown cover and legal cover.

- Quick and easy: Tempcover’s online system makes it quick and easy to purchase and manage your policy.

- 24/7 customer service: Tempcover offers 24/7 customer service, making it easy to get help when you need it.

Cons of Tempcover car insurance company:

- Higher premiums: For the same coverage, temporary policies can be more expensive than traditional policies.

- No loyalty bonuses: Many traditional insurers offer loyalty bonuses for customers who stay with them for extended periods of time. Tempcover does not offer this.

- No discounts: Many traditional insurers offer discounts for safe driving, good student grades, or bundling multiple policies. Tempcover does not offer any of these.

Tempcover can be considered the best car insurance provider due to its comprehensive coverage options, competitive pricing, and excellent customer service. Tempcover’s coverage options include Third Party, Fire and Theft, and Comprehensive, with the main advantages of this being cost savings and peace of mind. Additionally, the company offers competitive rates with discounts for multiple policies and safe driving. The customer service team is also available 24/7 and is known for providing friendly and knowledgeable service. Furthermore, Tempcover offers a variety of payment plans which help to ensure that customers can find the right insurance plan for their needs. Finally, the website is user-friendly and provides easy access to all the company’s services and tools.

This information about Tempcover can be seen in the table below.

| Company Name | Complaint Level | Handling Claims | Customer Services | Customer Loyalty Advantages |

|---|---|---|---|---|

| Tempcover | Low | Good | 24/7 customer service | None |

10. Age Co

Age Co Insurance (formerly Age UK Insurance) is a UK-based insurance company from London, England, founded in 2001. Age Co Insurance is a specialist insurer for the over 50s, providing a range of tailored insurance products for different needs and budgets. The company offers a range of products including home insurance, car, travel, and pet insurance, with a range of optional extras available. Age Co Insurance is a Not-for-Profit organisation and a registered charity in the UK. Being a Not-for-Profit organisation, all available profits are donated back into Age UK charitable organisations.

Age Co Insurance is primarily known for their car insurance policies and is a specialist insurer for the over 50s. Common coverage options through Age Co Insurance are comprehensive and third-party fire and theft coverage. Age Co Insurance aims to provide specialist insurance policies for the over 50s by offering a range of quality products at competitive prices.

Age Co Insurance has an overall average insurance rate, with different average insurance rates across different brackets. The average insurance rate for good drivers, drivers of a medium standard and new drivers vary. The average cost of comprehensive car insurance for the first quarter of 2022 in the UK was £392.

Age Co Insurance is one of the top-rated auto insurance companies within the UK and has gained a reputation for providing quality coverage, competitive premiums, and excellent customer service. Age Co Insurance is part of the Aviva group, a leading UK based insurance provider. In 2021, Age Co received 1042 general insurance complaints, putting its Insurance Complaints per 1000 Policies in Force ratio at 0.92

Pros of Age Co car insurance company:

- Discounts: Age Co offers a range of discounts that can help reduce the cost of premiums. Examples include discounts for having a good driving record, no claims bonus, and additional discounts for those aged over 50.

- Flexible payment plans: Age Co offers flexible payment plans, allowing customers to choose how they pay their premiums. This means customers can pay monthly, quarterly, or annually depending on their individual circumstances.

- Expert advice: Age Co has a team of experienced and knowledgeable advisors who can provide help and advice when it comes to car insurance. Age Co has a dedicated customer service team who are always on hand to answer any queries customers may have.

Cons of Age Co car insurance company:

- High premiums: Age Co car insurance is generally more expensive than other types of car insurance. This is because they specialise in providing coverage for older drivers.

- Limited coverage options: Age Co offers limited coverage options, so you may not be able to get the exact coverage that you need.

- Lack of flexibility: Age Co does not offer a great deal of flexibility when it comes to coverage. Once you select a policy, you are stuck with it. If your needs change, you may need to find a different insurer.

Age Co can be considered the best car insurance provider due to its customer service, wide range of coverage options, and comprehensive coverage plans. Elaborate on points. Age Co’s coverage options include comprehensive and third-party insurance, with the main advantages of this being financial protection and peace of mind. Furthermore, Age Co has some of the most comprehensive coverage plans in the industry, which include liability protection and accident compensation. Lastly, Age Co has some of the most competitive rates in the market, which can help customers save money on their premiums.

This information about Age Co can be seen in the table below.

| Company Name | Complaint Level | Handling Claims | Customer Services | Customer Loyalty Advantages |

|---|---|---|---|---|

| Age Co Insurance | 0.92 per 1000 policies | Good | Claims support, online quotes | Renewal discounts |

Comparison of Best Car Insurance Companies UK and Their Rates

The below table provides a comparison of the best car insurance companies in the UK and their rates. The table includes information on the company name, their history and years of experience and their active customer count so you can assess what car insurance might be right for you.

| Best Car Insurance Companies | Years of Experience | Active Customer Count |

|---|---|---|

| Saga | 72 | ~2,700,000 |

| CSIS | 134 | Unknown |

| Direct Line | 38 | ~811,000 |

| Admiral Group | 32 | ~1,000,000 |

| NFU Mutual | 113 | ~900,000 |

| By Miles | 7 | Unknown |

| Veygo | 7 | Unknown |

| LV= | 180 | ~1,600,000 |

| Tempcover | 14 | Unknown |

| Age Co | 22 | Unknown |

How to Compare Best Car Insurance Company UK Quotes

There are a few things to keep in mind when comparing UK car insurance providers. Firstly, it is important to compare the levels of cover offered by each insurer and make sure that the coverage meets your needs. To get the most for your money, it’s also important to compare the premiums offered by each company. In addition, the insurer’s financial stability and the quality of its customer service are important considerations. It is also useful to look at any additional services that are offered, such as breakdown cover and legal protection.

The most cost-effective auto insurance policy is not always the best choice. Instead, it is important to look at the quality of the cover and the customer service offered, as well as the cost. The company’s level of customer service and its financial viability should also be considered.

A procedure to compare car insurance quotes directly online is detailed below:

- Compare estimates from a variety of auto insurance providers. Start by looking at comparison websites like Money Supermarket, Compare the Market, Go Compare, and Confused.com. You can compare quotes from a variety of auto insurance companies using these websites.

- Enter your information. You will be required to enter personal, vehicle, and driving history information. This will assist the websites in providing you with the most competitive auto insurance quotes.

- Examine the policy’s specifics. Read the quotes carefully when you receive them. Check the excess, the amount of coverage, what is included and what is not included, and any restrictions.

- Select a policy. After comparing the quotes, you can select the one that best suits your requirements and finances. Before signing a policy, be sure to read the fine print.

- Think about additional perks. Breakdown coverage, legal protection, and personal accident coverage are examples of optional extras offered by some auto insurance companies.

- Look for savings. If you have multiple policies with the same company, are a named driver, or have not filed a claim in the past year, you may qualify for a discount from some auto insurance companies. Always inquire about any discounts that may be available.

What are the Average Costs of Car Insurance by Insurance Company?

The average cost of car insurance varies greatly by insurance company and is determined by a variety of factors such as the driver’s age, driving record, type of vehicle, and location. The larger the insurance company, the lower the rates they can offer due to the increased risk pool they have access to. However, rates can also vary significantly between different companies, even if they are both large national companies. It is important to shop around to compare rates and coverage options to ensure that you are getting the best possible rate.

The average cost of car insurance in the UK was £526 in 2020, according to data from confused.com. That amounts to £43.83 per month, but if you choose to pay monthly interest will be added, making the total cost higher. The average cost of car insurance in the UK varies greatly among insurance companies. The average annual rate for a comprehensive policy can range significantly higher or lower depending on the company. Below is a list of some of the major providers, with their average annual rates:

Below is an example list outlining the average Costs of Car Insurance through insurers in the UK across all brackets in 2020.

Annual costs:

- Aviva: £477

- Admiral: £558

- Direct Line: £608

- LV=: £624

- NFU Mutual: £746

- Saga: £1,114

Monthly costs:

- Aviva: £39.75

- Admiral: £46.50

- Direct Line: £50.67

- LV=: £52

- NFU Mutual: £62

- Saga: £92.83

Best Car Insurance Companies by Annual Cost

Choosing or classifying the best car insurance is important because it is a way to protect yourself from financial losses in the event of an accident or other issue. You can ensure that you are receiving the best coverage at the most affordable price by conducting research and comparing various policies. It is also important to make sure that your provider is reliable and has a good reputation. Having the best car insurance can give you peace of mind that you are protected in case something unexpected happens.

Annual cost refers to the amount of money spent on something over the course of a year. This may refer to expenses such as rent, insurance, taxes, utilities, or other recurring costs. The cheapest option almost always is to pay for a full year’s worth of insurance upfront if you can, as paying monthly will charge you interest.

To find the best insurance provider on the basis of annual cost the best solution is to find the insurers offering the lowest rates. Some of these insurance companies are listed in the table below:

| Best Insurance Companies by Annual Cost | Annual Cost |

|---|---|

| Direct Line | £614.01 |

| LV= | £667.63 |

| Privilege | £691.19 |

| Elephant | £836.27 |

| Diamond | £843.73 |

| eSure | £1034.90 |

| Churchill | £1078.56 |

- Direct Line has the lowest annual cost at £614.01, making it the most cost-effective option.

- LV= is the second most cost-effective option with an annual cost of £667.63.

- Churchill is the most expensive option with an annual cost of £1078.56

Tests revealed that AXA, Direct Line, and LV= are three of the largest national insurance companies that offer the cheapest car insurance quotes on average. This usually occurs through their “cheaper” brands, such as Swiftcover and Privilege. However, prices may vary depending on the driver’s location, the type of car, and their driving history. Prices can even fluctuate from one week to another.

Best Car Insurance Companies by Monthly Cost

Monthly costs refer to recurring expenses such as rent or a mortgage, utilities, car payments, insurance premiums, or subscription services. Paying monthly for car insurance is more expensive than paying annually for car insurance. You are effectively borrowing the entire cost of the insurance from the insurer if you pay in monthly instalments. You will be required to pay more money overall because you will be charged interest for this. Paying for insurance monthly rather than on an annual basis increased costs by approximately 10% in one scenario.

| Best Insurance Companies by Monthly Cost | Monthly Cost |

|---|---|

| Direct Line | £51.16 |

| LV= | £55.63 |

| Privilege | £57.59 |

| Elephant | £69.68 |

| Diamond | £70.31 |

| eSure | £86.24 |

| Churchill | £89.88 |

- Direct Line is the cheapest of the listed insurance companies, with a monthly cost of £51.16.

- LV= is the second-cheapest insurance company, with a monthly cost of £55.63.

- Churchill is the most expensive insurance company, with a monthly cost of £69.68.

It is worth noting that these estimates may be slightly inaccurate due to the different interest rates that different insurers charge for monthly payments. Furthermore, different insurers may also have different discounts available for making yearly payments. Thus, it is important to shop around and compare different insurers in order to find the best deal.

Best Car Insurance Companies by Driving Profile

A driving profile is a record of an individual’s driving behaviour. It may include information such as the number of miles driven, time of day, speed, and other driving patterns. It can be used to assess the risk of an individual’s driving behaviour and to help to improve their overall driving performance. Statista says that in 2020, the average cost of car insurance for people in their twenties was the highest out of all age ranges at £851.

In the United Kingdom, the lowest average age group for car insurance was drivers in their fifties, who paid an average of £468. However, this does not imply that your insurance will become less expensive as you get older, because the cost will increase again once you reach the age of sixty.

Some average prices are visible below:

- 20-year-olds: £851

- 25-year-olds: £719

- 35-year-olds: £639

- 45-year-olds: £575

- 55-year-olds: £468

- 65-year-olds: £491

- 75-year-olds: £752

Drivers between the ages of 17 and 24 pay an average of £932 for car insurance, which is 44% more than the average cost for all age groups. That is due to how insurers use risk to determine premiums, which may appear unfair if you drive with care and have never been in an accident. Insurers will price your policy based on the overall risk posed by younger drivers, who are statistically more likely to be inexperienced drivers who file claims. Therefore, the overall risk for your age group will increase the cost of your policy, even if you have never been in a car accident or been ticketed for speeding.

Although discrimination based on the grounds of gender does not take place anymore in theory, male drivers still pay more than female drivers on average. Confused.com reports that male motorists are paying an average of £574 for car insurance, almost £100 more than female motorists, who are paying an average of £477. Your driving profile will allow you to gain cheaper car insurance.

The cheapest car insurance providers as of January 2023 can be seen in the table below:

| Best Insurance Companies by Monthly Cost | Annual Cost |

|---|---|

| Direct Line Group (Privilege) | £290 |

| AXA (Swiftcover) | £291 |

| LV= | £338 |

| Aviva (QuoteMeHappy) | £404 |

| More Than (Essentials) | £408 |

| Admiral | £456 |

| Hastings Direct | £673 |

What are the Factors for Car Insurance Quotes’ Costs?

There are many factors that can affect your insurance rates. 15 of the Main Factors for Car Insurance Rates are listed below:

- Vehicle Accident Frequency: The number of accidents a vehicle has been involved in, and the cost of the repairs.

- Repair Costs for Vehicle: The cost of repairs for a vehicle following an accident, including parts and labour.

- Injury Claim Frequency: The number of injury claims related to a vehicle, and the cost of medical bills associated with them.

- Injury Claim Severity: The severity of injury claims, including physical and emotional trauma.

- Medical Costs: The cost of medical bills related to an accident, including hospital stays, rehabilitation, and medications.

- Insurance Claim Abuse: Attempts to abuse the system by filing false or exaggerated claims.

- Attorney Involvement in Insurance Claims: The involvement of lawyers in insurance claims, including fees and court costs.

- Litigation Climate: The legal climate in a particular area and the types of cases that are likely to be brought to court.

- Uninsured Motorists: The number of uninsured drivers on the road, which can increase the risk of an accident and the cost of repairs.

- Location: Where you live, park, and drive your car will affect your car insurance quote. Insurance companies consider the frequency and severity of claims in a certain area to figure out how much risk they are taking on when they insure you.

- Vehicle type: The type of car you drive, its age, and its safety record all play a role in determining how much your car insurance will cost.

- Driving record: Your driving record is a major factor in determining how much you will pay for car insurance. Insurance companies look at your record to assess your level of risk.

- Coverage type: The type of coverage you choose impacts your car insurance rate. Liability coverage is typically required by law, but you may decide to purchase additional coverage such as comprehensive, collision, personal injury protection, and uninsured/underinsured motorist coverage.

- Deductible: The amount you choose to pay out-of-pocket before your insurance kicks in affects your car insurance quote. The higher your deductible, the lower your insurance premium.

- Credit score: Your credit score is another factor that insurance companies use to determine your insurance rate. Your score reflects how well you manage your finances

How to Choose the Best Car Insurance Company

Choosing the best car insurance company can be a difficult task. You should consider all the factors, and decide How to Buy Car Insurance. There are many factors to consider, such as the company’s financial stability, customer service, cost, coverage, and discounts. By taking all of these factors into consideration, you can be sure to find the best car insurance company for your needs.

- Research – Before choosing a car insurance company, it is important to research about different companies, compare their policies and coverage, and look for the best deal. Take time to read reviews from customers who have already used their services and check the Better Business Bureau to make sure the company is reputable.

- Cost – Consider the overall cost of the policy. Compare the premiums, deductibles, and coverage of different companies and choose the one that is most cost-effective for you. Ask about discounts to see if you can reduce the cost of the policy.

- Coverage – Make sure the policy you choose covers all the aspects you need. Some policies may cover only basic liability, while others may cover comprehensive and collision coverage. Consider what type of coverage you need and make sure the policy offers it.

- Options – Check if the policy offers features such as roadside assistance or rental car coverage. These features can be beneficial and may be included in some policies.

- Customer Service – Consider the customer service offered by the company. Read reviews to see how customers rate their experience with the company and if they had any problems.

- Financial Stability – Check the company’s financial stability. Make sure the company is well-established and has a good financial rating.

- Reputation – Check the reputation of the company. Read the reviews and check the company’s BBB rating to make sure the company is reputable and trustworthy.

- Availability – Check if the company offers services in your area. Some policies may not be available in all states or regions.

Finding ways to reduce your car insurance cost can be a great way to save money each month. There are a variety of strategies you can adopt to lower your premiums. These include shopping around for the best deals, raising your deductibles, reducing coverage for older vehicles, and taking advantage of discounts. Read on for more details about each of these strategies. Shop around. It is important to shop around and compare different car insurance companies and their policies. Compare the premiums, deductibles, and coverage to find the most cost-effective policy.

- Ask for discounts – Many car insurance companies offer discounts for different factors such as having multiple policies, having a clean driving record, or being a student. Ask the company if you qualify for any of these discounts.

- Increase your deductible – A higher deductible may help to lower the cost of your policy. However, make sure you can afford the deductible in case of an accident.

- Pay in full – Paying for your policy in full may help to reduce the cost. Some companies may offer a discount for paying in full.

- Bundle policies – Some companies may offer discounts if you bundle your car insurance with other policies such as home, life, or health insurance.

Finding car insurance can be a daunting task. From comparing different policies to making sure you have the best coverage; it is easy to make mistakes that can cost you both time and money. To make sure you don’t make any costly errors, here are 3 key mistakes to avoid when searching for car insurance:

- Not Shopping Around – One of the biggest mistakes people make when choosing a car insurance company is not shopping around. It is important to compare different companies and their policies to find the best deal. For example, Aviva and Direct Line both offer car insurance, but the premiums and coverage will vary.

- Not Reading Reviews – Another mistake is not reading reviews from customers who have already used the company. Reading reviews can help you to determine the company’s reputation and customer service.

- Not Checking Financial Stability – It is important to check the company’s financial stability before buying a policy. Make sure the company is well-established and has a good financial rating. For example, LV= and CSIS are both well-established car insurance companies with strong financial ratings.

What is the Best Car Insurance?

The best car insurance will depend on your individual needs and circumstances. Factors such as age, driving history, the make and model of your car, and your desired level of coverage will all determine the best car insurance for you. It is important to shop around and compare car insurance policies to find the one that best meets your needs. Some of the top car insurance companies in England include Aviva, Direct Line, and Admiral, for example.

- Aviva provides a wide range of coverage options and competitive rates. Additionally, they provide a pay-as-you-go option, which may be advantageous for individuals who do not drive frequently.

- In addition to a courtesy car service and the option of a no-claims bonus, Direct Line provides flexible plans with a variety of coverage levels.

- Admiral provides a variety of coverage options and competitive rates. They also give discounts like a no-claims bonus and a discount for multiple cars.

Consider your individual requirements, including the type and value of your vehicle, how frequently you drive, and your budget when selecting the best car insurance provider for you. It is essential to compare policies from various insurers to ensure that you are receiving the best coverage at the lowest possible cost.

Below is an example of some top insurance providers in the UK and the purposes they are best suited for in individual circumstances:

- LV=: Best for cheaper rates

- Direct Line: Best for customer service

- Admiral: Best for multi-car

- Saga: Best for over-50s

- Tempcover: Best for temporary insurance

- Hastings Direct: Best for young drivers

- Swinton: Best for convicted drivers

- Churchill: Best for black box cover

What are the Best Car Insurance Companies UK by Insurance Type?

In the context of car insurance in England, insurance type refers to the level of coverage a person chooses from the various policies offered. There are five main types of insurance in England: third party only, third party fire and theft, fully comprehensive, black box insurance and pay-as-you-go. Each of these types of insurance offers different levels of coverage, from the bare minimum of third party to the comprehensive coverage provided by fully comprehensive.

| Car Insurance Type | Top Car Insurance Company |

|---|---|

| Third Party Only | Admiral |

| Third Party, Fire and Theft | LV= |

| Comprehensive Cover | Saga |

| Black Box (Telematics) | Churchill |

| Pay-as-you-go | By Miles |

| Temporary Insurance | Tempcover |

Some descriptions of insurance type and providers are visible below:

Third Party Only: Admiral is one of the top car insurance companies for third party only coverage. Third party only insurance is the most basic type of car insurance, providing coverage for any third-party damage caused by the policyholder’s vehicle. Admiral’s third party only coverage provides protection against damage caused to the other vehicle and any injury to the third party in the event of an accident.

Pay-as-you-go: By Miles is one of the top car insurance companies for pay-as-you-go coverage. This type of insurance is an ideal option for those who drive periodically because it allows the policyholder to pay for insurance only when they need it. By Miles’ pay-as-you-go coverage is based on the number of miles driven over a given period of time, meaning you won’t pay for more coverage than you need.

Temporary: Tempcover is one of the top car insurance companies for temporary coverage. This type of insurance is perfect for those who need coverage on a short-term basis. Tempcover’s temporary coverage can be purchased for as little as one day and can be extended up to 28 days.

Best Liability Car Insurance Companies

Liability car insurance is a type of insurance that provides coverage in the event of an accident or other incident in which you are found legally liable for any resulting damages. In the event of an accident or other occurrence for which you are found legally liable for any damages, liability car insurance provides coverage. This coverage pays for any costs incurred by the other party, such as medical bills, repair costs, and other damages.

Examples of UK-based companies that provide liability car insurance include Aviva, Admiral, LV=, AXA, Direct Line, and Hastings Direct.

| Top Car Insurance Companies for Liability Insurance |

|---|

| Aviva |

| Admiral |

| LV= |

| AXA |

| Direct Line |

| Hastings Direct |

It is important to know about this type of insurance to choose the best type of insurance, since it can provide the most comprehensive coverage in the event of an accident or other incident. The best company for Liability Car Insurance will depend on your individual needs and budget. For example, if you are looking for the most comprehensive coverage, Aviva may be the best choice. However, if you are looking for a more affordable option, Admiral might be the best choice.

Best Car Insurance Brands for Uninsured Motorist Coverages

Uninsured motorist coverage is an insurance policy that covers the costs of medical expenses, property damage, and other losses incurred from an accident caused by an uninsured driver. It is also referred to as UM/UIM coverage. Examples of companies that offer uninsured motorist coverage include Aviva, AXA, Churchill, Direct Line, and More Than.

It is important to know this to choose the best type of insurance because uninsured motorist coverage can provide financial protection if an accident is caused by an uninsured driver. Knowing which companies offer this coverage can help you make an informed decision and choose the best insurance policy for you.

| Top Car Insurance Companies for Uninsured Motorist Coverage |

|---|

| Aviva |

| Churchill |

| AXA |

| Direct Line |

| More Than |

When it comes to the best company for uninsured motorist coverage, it really depends on your individual needs and budget. All the companies mentioned above offer competitive coverage options, so it is best to compare quotes and coverage details to find the best policy for you.

Best Car Insurance Companies for Collision and Comprehensive Insurance

Collision and Comprehensive Insurance is a type of auto insurance that covers damage to your vehicle caused by collision with another vehicle or object, vandalism, or other covered events. It also provides financial protection against theft or fire.

UK-based examples of companies that offer Collision and Comprehensive Insurance include AIG, Aviva, AXA, Direct Line, Admiral, LV= and Hastings Direct. The best example of a company for collision and comprehensive insurance is one that offers comprehensive coverage for the lowest premium. It is important to look for companies that have excellent customer service and offer a wide range of discounts and incentives.

| Top Car Insurance Companies for Collision and Comprehensive Insurance |

|---|

| AIG |

| Aviva |

| AXA |

| Direct Line |

| Admiral |

| LV= |

| Hastings Direct |

The best company for Collision and Comprehensive cover will depend on your individual needs. You should compare different insurance providers to determine which one offers the best coverage for your specific needs at the best price. For example, if you are looking for the most comprehensive coverage, Direct Line may be the best choice. However, if you are looking for a more affordable option, Hastings Direct might be the best choice.

Best Car Insurance Companies for Personal Injury Protection Insurance

Personal Injury Protection (PIP) Insurance is a form of no-fault insurance that covers medical expenses, lost wages, and other costs related to injuries resulting from an auto accident, regardless of who is at fault for the accident. In the UK, some of the top insurers offering Personal Injury Protection Insurance include Aviva, Direct Line, LV=, and AXA. It is important to know the details of PIP insurance when selecting an insurance provider because it can provide a level of financial protection if you are injured in an accident.

| Top Car Insurance Companies for Personal Injury Protection Insurance |

|---|

| Aviva |

| AXA |

| Direct Line |

| LV= |

The best car insurance companies for Accident Forgiveness are those that offer competitive rates, good customer service and a range of additional benefits.

Examples of some of the best car insurance companies for Accident Forgiveness in the UK include Direct Line, Aviva, Churchill and LV=. These providers offer competitive rates and a range of additional benefits such as a no-claims bonus or a reduced excess if you opt for Accident Forgiveness as part of your policy.

Top Rated Car Insurance Companies for Gap Insurance

Gap insurance is a type of auto insurance that covers the difference between the amount you owe on a vehicle and its actual cash value in the event of an accident or theft. It is important to know whether an insurance provider offers gap insurance in order to choose the best provider for this type of coverage. It is important to know whether an insurance provider offers gap insurance in order to choose the best provider for this type of coverage. Different insurers will offer different levels of coverage, so it is important to compare policies and prices in order to make sure you are getting the most suitable coverage for your needs. It is also important to research the company’s customer service record and its financial stability before you commit to a policy.

Some of the best UK-based insurance companies for gap insurance include Admiral, Allianz, Aviva, AXA, Churchill, Direct Line, LV=, and Zurich.

| Top Car Insurance Companies for Gap Insurance |

|---|

| Admiral |

| Allianz |

| Aviva |

| AXA |

| Churchill |

| Direct Line |

| LV= |

| Zurich |

These providers are good for gap insurance because they offer comprehensive coverage at competitive prices. They also have a good reputation for customer service and financial stability, so customers can trust that their policies will be handled quickly and effectively. In addition, these insurers have a wide range of flexible coverage options, so customers can find the best policy for their individual needs.

Best Car Insurance Companies for New Car Replacement

New Car Replacement is a benefit offered by some insurers, in which if a car is written off or stolen within the first year of ownership, the insurer will pay for a new car of the same make and model. It is important to know if a car insurance provider offers New Car Replacement, as this can provide financial protection in the event that a new car is written off or stolen within the first year of ownership. Without this benefit, the owner of the car would be liable for the full cost of replacing their car.

UK-based insurers that offer New Car Replacement include Direct Line, Aviva, LV=, AXA, Admiral, and Hastings Direct.

| Top Car Insurance Companies for New Car Replacement |

|---|

| Admiral |

| Aviva |

| AXA |

| Churchill |

| Direct line |

| LV= |

The best options for New Car Replacement depend on the specific needs of the customer. Different insurers offer different levels of cover, so it is important to compare the different policies available.

Best Car Insurance Companies for Temporary Car Insurance

Temporary Car Insurance is a type of insurance that provides coverage for a short period of time, from as little as one day up to a maximum of 28 days. Temporary Car Insurance is usually for the same car and driver and is ideal for those who only need a car for a short period of time, such as for a holiday, test drive or even if you are lending a car to a friend.

| Top Car Insurance Companies for Temporary Car Insurance |

|---|

| Veygo |

| Aviva |

| Tempcover |

| RAC |

To find the best temporary car insurance for your needs, it’s important to know which insurance companies offer it. Terms and conditions, as well as levels of coverage, will vary between insurers.

- Veygo: Veygo offers temporary insurance coverage for drivers aged 17-75. It is a convenient and cost-effective way to get coverage when needed.

- Aviva: Aviva offers short-term policies that allow drivers to get coverage for as little as one day. They also offer additional coverage options for drivers who need more comprehensive coverage.

- Tempcover: Tempcover is an online-only provider of temporary insurance. It offers comprehensive coverage for drivers aged 17-75 and is easy to purchase with no hidden fees.

- RAC: RAC provides short-term insurance policies that are tailored to the needs of drivers. They also offer additional coverage options and discounts for drivers who need more comprehensive coverage.

Best Car Insurance Companies for Pay-per mile Insurance

Per-mile or pay-per-mile insurance is a type of insurance policy in which the user pays an agreed-upon amount for every mile they drive. This type of policy is ideal for drivers who do not use their vehicle as frequently and so do not need the same level of coverage as a regular or full-time driver.

| Top Car Insurance Companies for Pay-per-mile Insurance |

|---|

| By Miles |

| AA |

| Nationwide SmartMiles |

| RAC |

| Cuvva |

| Metromile |

The best insurance providers for temporary pay-per-mile insurance vary depending on the individual’s specific needs. Some of the top-rated providers include By Miles Insurance, Cuvva, RAC, AA, Metromile and SmartMiles.

Each of these providers offer competitive rates, excellent customer service, and comprehensive coverage. By Miles Insurance, for example, offers a range of coverage options and discounts for low-mileage drivers, while Metromile offers pay-per-mile coverage and features an app that helps customers track their miles.

Best Car Insurance Companies for SR-22 Insurance

In the USA, SR-22 insurance is a type of car insurance required by some states for high-risk drivers. It is a document filed by an insurance company with the state’s department of motor vehicles, certifying that a driver has the minimum liability insurance required by the state. It is also known as a certificate of financial responsibility. There are several reasons why a driver may be considered a high-risk driver, including a history of traffic violations, multiple accidents, and/or multiple claims. In addition, some states require SR-22 insurance for drivers with a suspended or revoked licence.

| Top Car Insurance Companies for SR-22 Insurance |

|---|

| Allstate |

| Geico |

| Progressive |

| State Farm |

| Liberty Mutual |

Examples of insurers that offer SR-22 insurance include Allstate, Geico, Progressive, State Farm, and Liberty Mutual. It is important to know about SR-22 insurance in order to choose the best insurance provider for this. Different insurance providers have different policies, coverage amounts, and pricing, so it is important to research each company before committing to a policy. Additionally, not all insurers offer SR-22 insurance, so it is important to make sure the company you choose does offer it.

SR-22 insurance is not available in the UK.

Great Car Insurance Companies for Vanishing Deductibles

In the USA, Vanishing Deductibles are a function of car insurance coverage that rewards policyholders for having a good driving record by gradually reducing the deductible amount after each claim-free year. This is similar to a No Claims Bonus (NCB) in the UK, but refers to the cost of the excess (or deductible in this case) decreasing as opposed to a decrease in insurance premiums. Knowing which insurers offer Vanishing Deductibles is important in order to compare and contrast different policy options in order to find the best coverage and savings for individual drivers.

| Top Car Insurance Companies for Vanishing Deductibles |

|---|

| Allstate |

| Geico |

| Progressive |

| USAA |

| State Farm |

| Liberty Mutual |

| Farmers Insurance |

The best insurance providers for Vanishing Deductibles will vary. The best insurance providers for Vanishing Deductibles will vary depending on individual drivers’ needs, driving history, and location.

Best Car Insurance Companies for Usage-based Insurance

Usage-based insurance (UBI) is also known as Pay-As-You-Drive (PAYD) or Pay-How-You-Drive (PHYD) insurance. Usage-based insurance (also known as pay-as-you-drive or pay-how-you-drive insurance) is an insurance product that charges policyholders based on their actual miles driven and/or driving behaviour. This type of insurance can be beneficial for drivers who drive fewer miles and/or drive more safely, as they can be rewarded with lower rates.

| Top Car Insurance Companies for Usage-based Insurance |

|---|

| By Miles |

| AA |

| Nationwide SmartMiles |

| RAC |

| Cuvva |

| Metromile |

The above insurance providers offer usage-based insurance policies, which can be beneficial for many drivers. These policies allow drivers to pay for the miles that they actually drive, rather than a set annual premium. This can lower costs for those who don’t drive a lot, as they will only be paying for the miles that they use. Additionally, many of these providers offer other benefits such as discounts for low-mileage customers, pay-as-you-go options, and coverage tailored to the individual. This gives drivers more control over their coverage and allows them to customise their policy to fit their needs.

What are the Best Car Insurance Company Discounts?

Some examples of Car Insurance Company Discounts in the UK include:

- No Claims Discount: Many car insurance companies in the UK offer discounts to customers who have not made any claims on their policy for a period of time.

- Multi-Car Discount: If you have more than one car insured with the same company, you may be eligible for a multi-car discount.

- Low Mileage Discount: Some insurers offer discounts for customers who do not drive more than a certain number of miles per year.

- Defensive Driving Discount: Taking a defensive driving course may entitle you to a discount on your car insurance.

- Pay-As-You-Go: Paying for your car insurance in monthly or quarterly instalments instead of in one lump sum can often result in a discount.

- Good Credit Discount: Good credit can earn you a discount on your car insurance policy.

- Loyalty Discount: Staying with the same insurer for an extended period of time can often result in a loyalty discount.

Some examples of companies in the UK offering car insurance discounts are listed below.

- Admiral: No Claims Discount (NCD) and Multi-Car Discounts.

- Aviva: No Claims Discount and Multi-Car Discounts.

- Direct Line: No Claims Discount, Multi-Car Discounts, and Telematics Discounts.

- LV=: No Claims Discount, Multi-Car Discounts, and Courtesy Car Cover Discounts.

- Churchill: No Claims Discount, Multi-Car Discounts, and Courtesy Car Cover Discounts.

What is a Car Insurance Discount?

Car insurance discounts are reductions in premiums that policyholders can receive for various reasons. Car Insurance Discounts can be based on factors such as the type of car, age, driving record, and other factors. Common discounts include no claims, multi-car, safe driver, and loyalty discounts.

Can you use a Car Insurance Discount for a Temporary Car Insurance?

No, car insurance discounts are not applicable to temporary car insurance policies. Temporary car insurance policies are typically more expensive than traditional car insurance policies due to their short-term nature, and discounts are not available for them.

Temporary car insurance policies are typically more expensive than traditional car insurance policies because they provide only short-term coverage. Because of the short-term nature of the policy, there is a higher risk associated with it, and the insurer must charge a higher premium to cover that risk. As a result, discounts are not available for temporary car insurance policies.

What are the Best Car Insurance Companies for Handling Insurance Claims?

Three of the top insurance companies in the UK for handling insurance claims are Admiral, Direct Line, and Aviva.

- Admiral: This company has a 97% customer satisfaction rating and over 90% of their customers have had a positive experience with their claims process. They have a claims handling process that is quick, comprehensive, and efficient. On average, they settle claims within 2 weeks, with most customers receiving their payments within 7 days.

- Direct Line: Direct Line has a 98% customer satisfaction rating and around 95% of their customers have had a positive experience with their claims process. They have a fast and efficient claims process, and their average claim settlement time is 2 weeks.

- Aviva: Aviva has a 95% customer satisfaction rating and over 90% of their customers have had a positive experience with their claims process. They have a very efficient claims process, and their average claim settlement time is 1 week.

Most insurance claims are completed within 30 days across all insurers.

What are the Best Car Insurance Companies for Customer Services?

According to consumer intelligence, most customers have little to no contact with their insurer beyond the initial purchase and renewal of their insurance policies. 90% of UK house and auto insurance customers only speak with their insurer 1-2 times per year.