Largest Auto Insurance Companies in the U.S. for 2024: A Comprehensive Overview of Market Leaders

here are thousands of licensed insurers in the United States, but the 10 largest insurance companies account for 74% of the market for car insurance coverage. While these top auto insurance companies are all well known, they have different costs, customer service ratings, and coverage options. We’ve broken down their differences below.

What are the largest auto insurance companies?

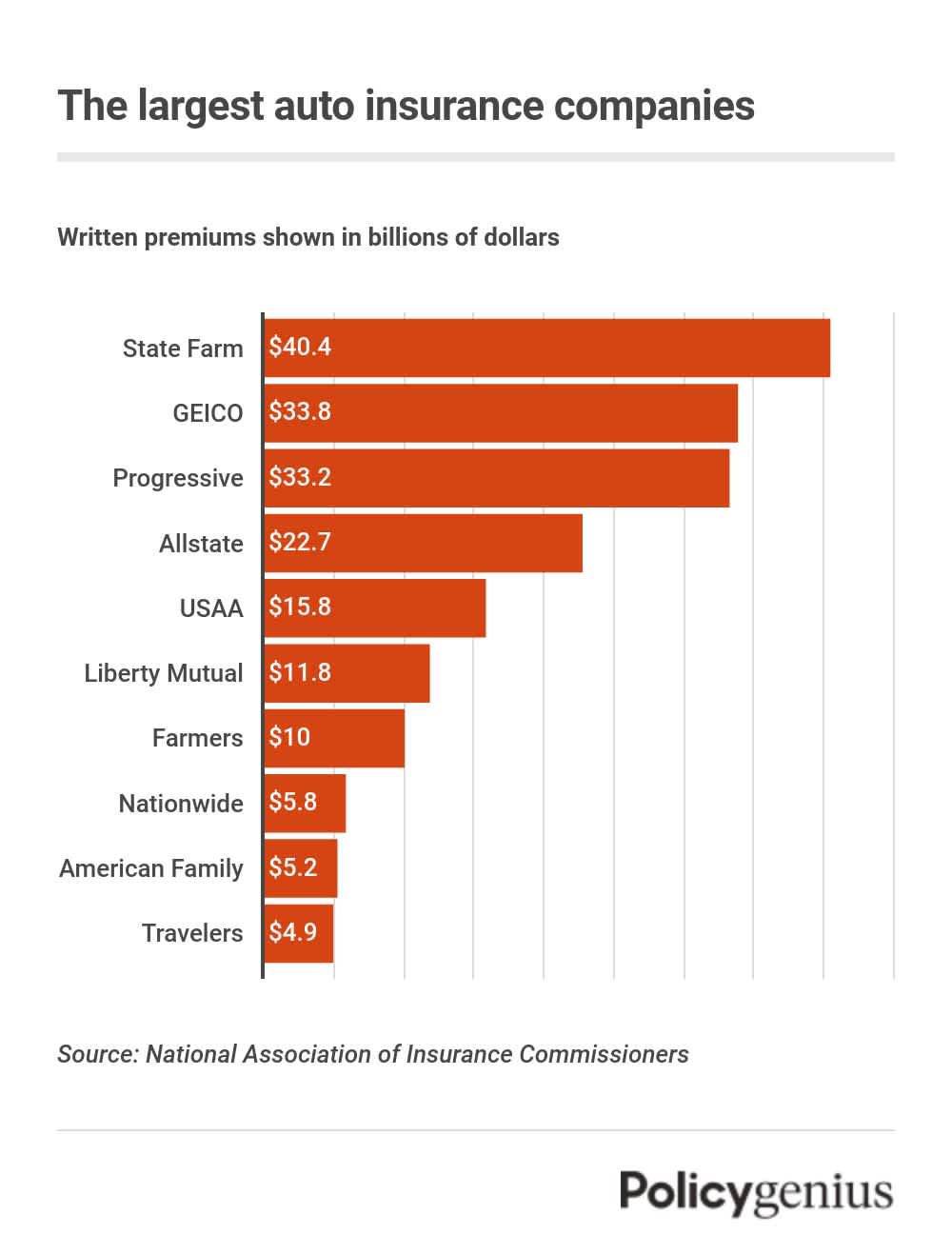

The largest auto insurance company in the country is State Farm, which by itself takes up 16% of the car insurance market in the U.S. According to the most recent data from the National Association of Insurance Commissioners, State Farm issued $40.4 billion dollars in premiums — nearly $7 billion more than the second largest insurer, GEICO.

Together, the top 10 auto insurance providers took in $184 billion from written premiums in 2020, the most recent year with data available. The entire industry issued $250 billion in premiums in the same year. The most popular car insurance companies took in 74% of this amount on their own.

Seven of the top 10 car insurance companies issued at least $10 billion in auto premiums in 2020, and all of them took in at least $1 billion. In fact, no insurer in the country’s top 28 largest insurance companies took in less than $1 billion in that year.

Written premiums in billions of dollars

1. State Farm

In addition to being the largest company, State Farm is also one of the top companies in the U.S. for its cheap insurance costs. The company is one of the more affordable options for coverage for young and old drivers, as well as those who have prior incidents on their records.

State Farm also has a history of highly rated customer service — somewhat uncommon among the largest car insurance companies. State Farm’s strong local presence has helped the company achieve consistently high scores on J.D. Power’s annual claims satisfaction study.

2. GEICO

Originally founded 86 years ago as an insurance provider for federal employees, GEICO started selling auto insurance to the general public in 1974. Today, GEICO has more than 18 million policies in force, insuring more than 28 million vehicles across every state and Washington, D.C.

GEICO is most known for its cheap costs of coverage. We found that GEICO’s policies cost $402 per year for minimum coverage and $1,179 for full coverage. Also, the range of insurance discounts that GEICO offers its customers means that many policyholders can get car insurance for an even lower cost.

In addition to being the best insurance company for most people who are looking for low rates, GEICO is also a good choice for those who want an insurer with a convenient app. Its customer service, however, ranks near the national average for car insurers.

3. Progressive

The youngest of the largest insurance companies, Progressive was founded in 1937 as a specialty insurer for high-risk drivers. Today, Progressive serves a wide range of drivers across all 50 states and Washington, D.C.

Progressive’s car insurance premiums are generally affordable. The company is also known for its popular cost-savings products. Its “Name Your Price” tool allows shoppers to explore coverage options within their budget. And its “Deductible Savings Bank” lets drivers lower their deductibles by $50 every six month they go without making a claim.

Many types of vehicle owners can get coverage with Progressive, too. Since the company has affordable options for motorcycle, renters, and boat owners — and more — you can also usually get discounts for bundling more than one line of coverage.

4. Allstate

Allstate was originally founded in 1931 by the Sears company as a way to sell car insurance by mail. In the present day, Allstate has expanded to a major car insurance company with nearly 50,000 employees and a vast network of local offices.

Though Allstate’s rates are more expensive than the average cost of coverage, shoppers who want easy access to a physical office in their community will likely be satisfied with the company. Also, Allstate’s discounts and Drivewise usage-based program allow some drivers to lower their cost of coverage.

5. USAA

USAA was founded in 1922 as a way to provide affordable insurance to members of the armed forces. That mission continues today, as USAA still only offers coverage to active, reserve, and retired members of the military and their families.

If you can get car insurance from USAA, you have access to one of the best (and the cheapest) insurance companies. Compared to the other largest companies — even GEICO — USAA is the cheapest option for coverage.

The company’s claims satisfaction is also consistently higher than other top auto insurers. J.D. Power has ranked USAA at the top of its claims satisfaction survey for years. USAA also receives few complaints from its policyholders for service — even though the insurer doesn’t have an extensive physical presence like the other biggest insurance companies on our list.

6. Liberty Mutual

Regardless of what you pay in your area for coverage at Liberty Mutual, the insurer offers a number of discounts that make saving money easy for many people. In particular, the company offers a 12% discount just for signing up online. It also partners with Navy Federal and offers a similar discount to members.

One weak point of Liberty Mutual compared to other large auto insurance companies is its reputation for customer satisfaction. Its claims satisfaction ranks below other major companies, though its local offices can make it easier to manage your policy if you prefer in-person service.

7. Farmers Insurance

Farmers was originally started as an alternative way for farmers to get affordable insurance, but today the insurer has more than 19 million policies (and coverage isn’t just for farmers anymore) in 10 million homes, along with more than 21,000 employees.

The customer service that Farmers provides is often rated highly. According to the J.D. Power Claims Satisfaction survey, Farmers has the best customer service among all of the other top car insurance companies (besides USAA).

While Farmers’ claims satisfaction is high, its insurance can be expensive. We found that auto coverage costs an average of nearly $2,000 per year for a full coverage policy. This makes Farmers the most expensive option of the largest insurance providers in the U.S. However, you may still be able to find cheap coverage thanks to the insurer’s long list of discount opportunities.

8. Nationwide

When it was discovered that farmers tended to be more careful drivers than their urban counterparts, Nationwide was founded 96 years ago in Ohio as a way to offer farmers cheap coverage. Today, Nationwide is a Fortune 100 company with millions of policies in force — and not just for farmers anymore.

If you’re looking for cheap car insurance, Nationwide could be a good pick for you. Costing $1,569 per year for a full coverage policy, the insurer’s premiums are lower than average. Nationwide also offers a handful of discounts that could make your car insurance even more affordable.

While its rates may be low for some, Nationwide doesn’t have a history of highly rated customer service. It’s ranked below average for claims satisfaction by J.D. Power. However, it does rank above Allstate in this category.

9. American Family

Operating since 1927, American Family Insurance has lower-than-average rates than other large insurance companies, trailing only behind USAA, State Farm, and GEICO. The insurer is also highly rated for claims satisfaction.

Its main flaw? American Family only offers car insurance in 19 states (many of them in the central part of the country). Compared to the other major insurance companies on this list, American Family’s market is much more limited.

10. Travelers

Travelers is the oldest company on our list of the largest auto insurance companies. It was founded in 1864, meaning the insurer has been writing insurance policies since before the invention of the car.

The cost of car insurance with Travelers is lower than average for most people, with the minimum coverage policy ringing in at $1,586 per year. This places Travelers right in the middle of the other large insurance companies when it comes to price. You could also get lower rates by qualifying for any of the many discounts offered by Travelers.

Despite its average rates, Travelers has below-average claims satisfaction, according to J.D. Power’s survey. However, the insurer’s rank for its claims satisfaction service is better than Allstate’s.

Largest auto companies by state

State Farm is number one largest auto insurer company in the U.S., and it’s also usually the top insurance company at the state level. State Farm is the largest auto insurance company in 31 states. GEICO is the largest in 10 states (including Washington, D.C.). Progressive is the biggest insurance company in nine states, and MAPFRE in just one, Massachusetts.

On average, the largest insurance company takes up nearly 21% of the market in a state. However, in Washington, D.C., the biggest car insurer, GEICO, accounts for more than 36% of the market. Conversely, the top company in California, State Farm, has a market share of just around 13%.

How to find the right auto insurance company for you

As you shop for the right auto insurance to fit your needs, you should:

-

Consider how much coverage you need. While nearly every state requires car insurance, your car’s value, the number of drivers in your household, and your location will influence how much coverage you should get.

-

Have a price in mind. When you know how much auto insurance you need, you should decide how much you’re able to spend on coverage. Keep in mind that if you can afford to pay your entire premium for the year upfront, you could qualify for a discount.

-

Compare quotes from multiple companies. Although the amount of insurance you need affects what you pay, you don’t need to choose between having enough protection and cheap coverage. Policygenius can help you compare rates from popular insurance companies to ensure you find the best rates in your area for the amount of coverage you want.

We also recommend that you get a full coverage policy with comprehensive and collision protection, so that you don’t have to pay for damage to your car yourself. However, if your deductible is more expensive than it would be to replace your car, you may only need less coverage.

Methodology

To find the largest auto insurance companies in the country, Policygenius analyzed data from the National Association of Insurance Commissioners (NAIC). The NAIC’s Property and Casualty Market Share Report [1] , which was published in 2021, lists the total written premiums and market share — nationally and at the state level — for the top 125 insurance groups in the country.

Policygenius also analyzed car insurance rates provided by Quadrant Information Services for every ZIP code in all 50 states plus Washington, D.C. For full coverage policies, the following coverage limits were used:

-

Bodily injury liability: 50/100

-

Property damage liability: $50,000

-

Uninsured/underinsured motorist: 50/100

-

Comprehensive: $500 deductible

-

Collision: $500 deductible

We determined average rates for full coverage using averages for single drivers, aged 30 years old. Our sample vehicle was a 2017 Toyota Camry LE driven 10,000 miles per year.